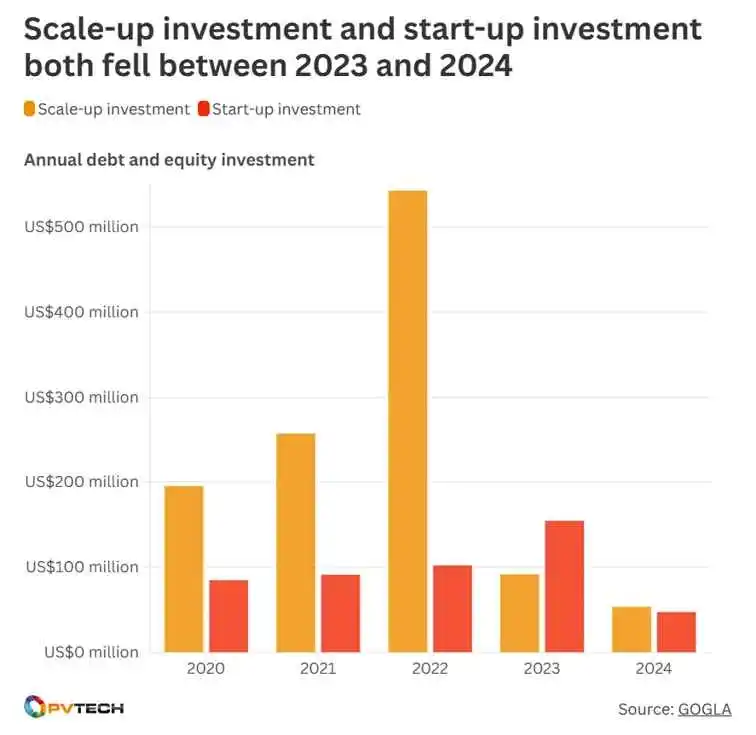

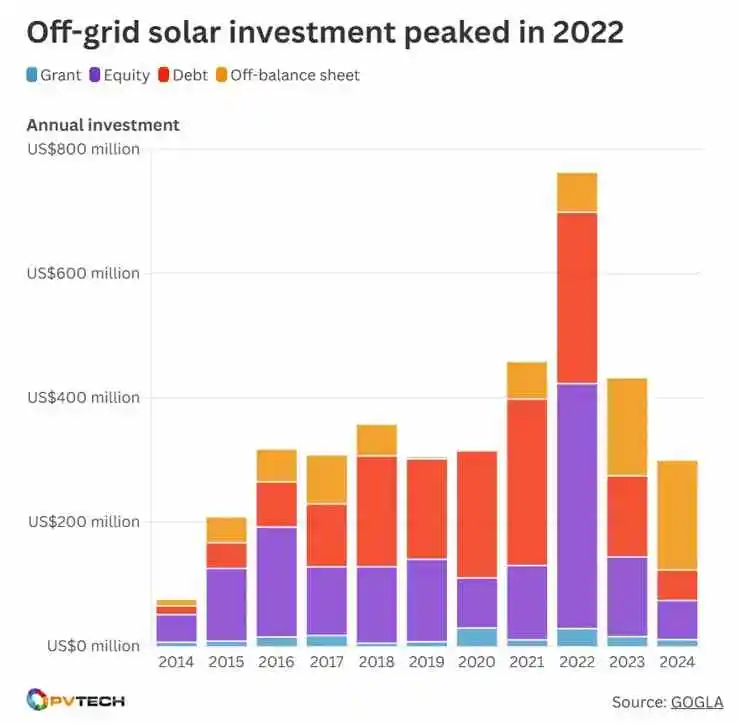

The global off-grid solar sector, once a rapidly expanding frontier in the renewable energy movement, has experienced a striking contraction in 2024. According to the latest GOGLA report, total investments into the sector slightly exceeded $300 million—a 30% decrease compared to 2023. Even more concerning is the 70% drop in early-stage capital investment, signaling shrinking enthusiasm for startup innovation in the space. But while the numbers may look grim on the surface, a closer analysis reveals a more nuanced landscape filled with both risks and opportunities.

Why Is Off-Grid Solar Investment Declining in 2024?

The dramatic dip in global off-grid solar investment can be attributed to multiple intersecting factors. One of the most significant is the overall contraction of venture capital across developing markets, especially in Sub-Saharan Africa, where 80% of the global unelectrified population resides. In fact, venture capital in Africa dropped by 25% year-on-year, heavily influencing the solar sector.

Additionally, many governments and institutional investors are recalibrating their strategies in response to changing global financial conditions, such as rising interest rates and post-pandemic economic caution. These macroeconomic realities are making high-risk, low-margin investments like early-stage solar ventures less appealing in the short term.

Is the Market Maturing or Losing Momentum?

While the drop in funding may appear to be a warning sign, it could also suggest a maturing market. Large-scale off-grid solar projects continued to attract relatively stable investment—$229 million in 2024, down only slightly from $240 million in 2023. This indicates that established players with proven business models are still considered valuable and viable.

What we’re witnessing is not necessarily a decline in demand, but rather a natural evolution. As the market matures, capital is flowing away from unproven startups and into scalable, structured projects. That’s a sign of growing investor sophistication and a move toward long-term sustainability, not just rapid growth.

What Does This Mean for Emerging Markets Like Africa?

Africa remains the largest off-grid solar market globally, making the continent’s investment climate highly influential. The reduced availability of capital, especially in early-stage funding and grants (which fell by more than 50%), could have real consequences for electrification efforts in rural and underserved areas.

Yet, this could also be a pivotal moment. Governments and large-scale development organizations are now stepping in with structured financing tools. For example, the World Bank’s $750 million energy project in Nigeria, including $300 million dedicated to off-grid solar, shows a shift from private capital to public-private hybrid models aimed at bridging the $9 billion affordability gap.

How New Financing Models Can Revive Growth?

Innovative financing tools, particularly results-based financing (RBF), are emerging as a solution to the off-grid sector’s current challenges. Unlike traditional funding mechanisms, RBF ties investment to project outcomes, improving accountability and reducing perceived risk.

Over $900 million in RBF has already been pledged to off-grid projects, with more than half of that secured in just the last two years. These funds not only support end-user affordability but also help suppliers scale operations and achieve unit economics that attract commercial capital. In a tightening investment landscape, such outcome-oriented funding models may prove crucial to long-term sector resilience.

What Opportunities Exist for Suppliers and Buyers?

Even in a tighter investment climate, significant opportunities remain—especially for experienced suppliers like USFULL. As a China-based manufacturer with nearly 20 years of experience, 7 production lines, and exports to over 90 countries, USFULL is well-positioned to meet global demand for high-quality, cost-effective solar products.

Buyers in emerging markets are looking for trusted suppliers that offer both competitive pricing and certified quality. The current market shake-up may drive more of these buyers to established brands like USFULL that can deliver on both product performance and delivery timelines.

Will Off-Grid Solar Continue to Attract Investment in the Long Term?

Yes—despite short-term setbacks, the long-term outlook for off-grid solar remains promising. Demand for decentralized energy remains high, especially in countries with unreliable grids or vast rural regions. The sector’s importance in delivering clean, scalable energy solutions to underserved communities ensures that it will remain a policy and investment priority.

Furthermore, as more results-based mechanisms, subsidies, and blended finance tools are introduced, investment risk will be reduced, bringing more private and institutional capital back into the space. Smart suppliers and buyers who adapt to the new financial landscape will be the biggest winners in the next phase of growth.

A Turning Point, Not a Dead End

The 30% decline in off-grid solar investment in 2024 should not be seen as a sign of collapse but rather as a turning point. The market is transitioning from youthful exuberance to strategic growth. This period calls for resilient suppliers, informed buyers, and innovative financing to work together toward sustainable energy access.

Unter USFULL, we remain committed to powering progress across developing markets with cutting-edge solar pumping inverters, DC protection accessories, and customized energy solutions. Now more than ever, we believe that high-quality, accessible solar technology can transform lives—and we’re here to lead that transformation.