Unstable U.S. trade policies have made solar procurement risky — leading to price spikes, project delays, and supplier failures. Choosing a reliable solar energy equipment manufacturer solves the chaos.

Despite trade uncertainty, U.S. solar module prices remain relatively stable in 2025. Domestic modules decreased by 2%, while imported module prices hovered around $0.255/W, according to Anza’s latest market data.

Let’s explore the current price trends and what they mean for global solar buyers like you.

US Solar Module Pricing Trends: A Mixed But Stable Outlook

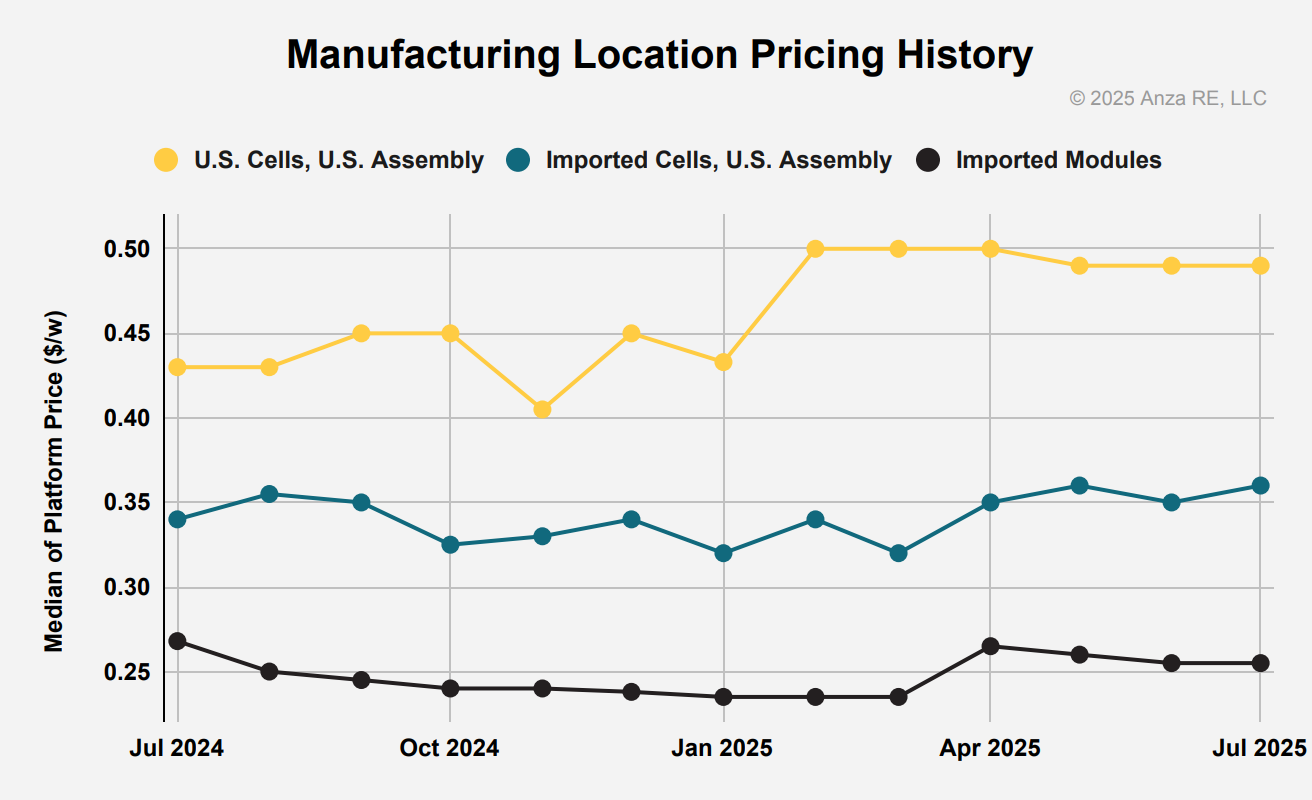

In the face of complex U.S. trade developments and supply chain disruptions, solar module prices have shown surprising resilience. According to the Domestic Content Report released by Anza, a prominent solar and storage supply chain platform, prices across all module categories have seen minimal movement between April and July 2025.

Domestic modules with U.S.-made cells decreased slightly, from $0.50/W to $0.49/W, a 2% drop.

Modules assembled in the U.S. using imported cells increased marginally from $0.35/W to $0.36/W.

Fully imported modules dipped slightly from $0.26/W in April to $0.255/W in July.

Though these fluctuations appear minor, they reflect a broader shift in buyer confidence and sourcing strategy amid regulatory and pricing uncertainty. For international buyers relying on a stable supply of solar energy equipment, these pricing patterns offer both opportunities and red flags — depending on how well their suppliers navigate the changing landscape.

US Solar Module Pricing Trends: A Mixed But Stable Outlook

In the face of complex U.S. trade developments and supply chain disruptions, solar module prices have shown surprising resilience. According to the Domestic Content Report released by Anza, a prominent solar and storage supply chain platform, prices across all module categories have seen minimal movement between April and July 2025.

Domestic modules with U.S.-made cells decreased slightly, from $0.50/W to $0.49/W, a 2% drop.

Modules assembled in the U.S. using imported cells increased marginally from $0.35/W to $0.36/W.

Fully imported modules dipped slightly from $0.26/W in April to $0.255/W in July.

Though these fluctuations appear minor, they reflect a broader shift in buyer confidence and sourcing strategy amid regulatory and pricing uncertainty. For international buyers relying on a stable supply of solar energy equipment, these pricing patterns offer both opportunities and red flags — depending on how well their suppliers navigate the changing landscape.

The Real Cost of Domestic vs Imported Solar Modules

For buyers weighing options between U.S. domestic and imported modules, the price spread is becoming increasingly relevant. The premium for domestically produced solar modules — particularly those made with U.S.-sourced solar cells — has widened to nearly $0.23/W compared to fully imported modules. This premium is largely attributed to benefits tied to tax credits, tariff protections, and local sourcing incentives.

Yet, for international buyers sourcing from solar energy equipment suppliers in China, such as USFULL, these rising premiums highlight a strategic advantage. By avoiding U.S.-based manufacturing costs and trade policy risks, Chinese suppliers can offer competitive pricing and consistent quality — without being entangled in FEOC (foreign entity of concern) regulations or Section 232 investigations.

Trade Policy Uncertainty: A Global Ripple Effect

Behind the seemingly stable prices lies a tense policy climate. The U.S. market has been under continuous pressure due to new regulatory layers introduced by recent executive orders. Among the key concerns are:

Foreign Entity of Concern (FEOC) rules

Investment Tax Credit (ITC) safe-harbour deadlines

Antidumping (AD) and Countervailing Duties (CVD) targeting suppliers from India, Indonesia, Laos, and even Chinese manufacturers operating abroad

A new Section 232 probe into imported polysilicon

These developments complicate the cost and logistics of sourcing solar modules. For buyers in developing regions, such as North Africa or the Middle East, where seasonal solar project timelines are strict, delays in shipment or sudden price hikes due to policy changes can result in lost revenue and missed selling seasons.

This underscores the value of working with experienced solar energy equipment manufacturers like USFULL, who understand global logistics and compliance requirements — ensuring you stay ahead, not behind.

U.S. Manufacturing Response: Growth with Caution

While pricing remains stable, the response from U.S. manufacturers reveals a more cautious outlook. Companies like Meyer Burger have paused or shut down plants due to insufficient incentives and unresolved trade risks. In contrast, others like Heliene and SEG Solar are cautiously scaling up operations with smaller capacities — a sign of limited confidence in long-term stability.

How Global Buyers Should Navigate the Pricing Landscape

For international solar buyers, especially in emerging markets, navigating the global pricing trends means aligning with suppliers that:

Offer certified products (CE, TUV, IEC, ISO9001, INMETRO)

Maintain transparent documentation (avoiding false certifications)

Provide fast and clear communication

Deliver cost-efficient and high-performance solar energy equipment

USFULL checks all these boxes. From our DC circuit breakers to combiner boxes and DC surge protection devices, we build systems designed for customization, reliability, and ease of installation — all while offering pricing that helps you stay competitive in your market.

What This Means for the Future of Solar Procurement

Looking ahead, the U.S. market may experience supply limitations and further price increases, especially as FEOC restrictions tighten and Section 45X production incentives begin to phase down post-2027.

Anza’s forecast is clear: domestic cell providers will nearly double by 2027, but module suppliers will grow more slowly, reflecting caution in the market. In contrast, demand for imported solar energy equipment is expected to rise as buyers search for reliable and price-stable alternatives.

Secure Your Supply Chain Before It’s Too Late

In an industry where timing is everything, trade uncertainties shouldn’t derail your solar projects. With pricing in the U.S. under pressure and policy risks mounting, smart buyers are locking in partnerships with solar energy equipment suppliers who deliver value, consistency, and peace of mind.

Contact USFULL today at www.usfull.com or email us at fullwill@usfull.com to explore how our solutions — from DC circuit breakers to solar pump inverters — can power your next project with confidence.