Soaring tariffs are inflating solar and storage costs in the US; this disrupts projects and shrinks margins—but reliable industrial inverter partners offer a way forward.

New tariffs on solar and energy storage imports are expected to increase project costs by up to 50%, delay deployments, and intensify sourcing issues. Reliable VFD manufacturers in China and flexible supply chain strategies are crucial.

Curious how the solar and storage sectors will adapt? Read on to uncover the full market impact and key supplier solutions.

Why Are Tariffs Driving Up Costs in the US Solar Market?

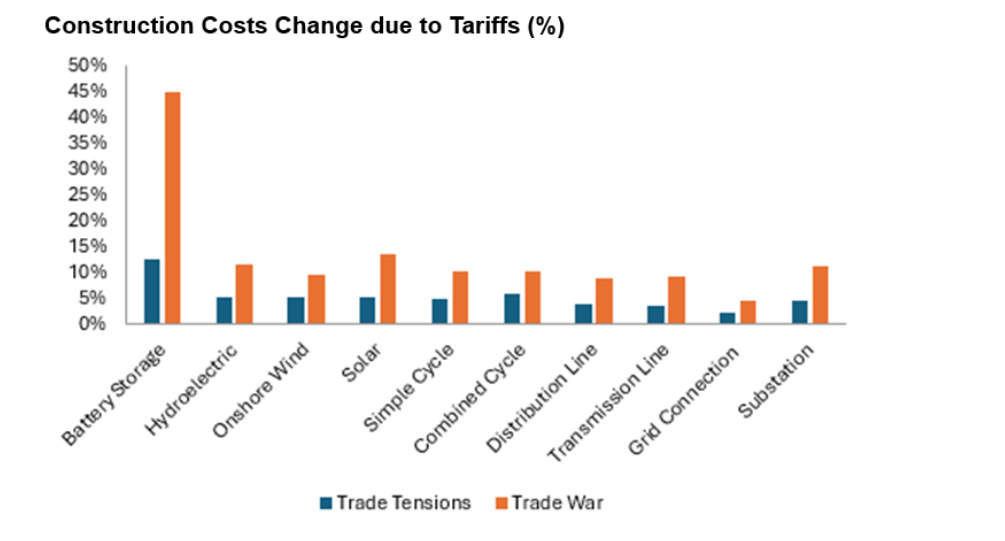

The US solar industry already faces some of the highest module prices globally, thanks to years of trade restrictions on Chinese suppliers and fluctuating anti-dumping duties on Southeast Asian goods. Now, the Biden administration’s tariff policies—extending from the Trump-era “reciprocal tariffs”—threaten to drive costs even higher. Under a moderate “trade tensions” scenario, solar project costs in the US are projected to be 54% higher than in Europe and a staggering 85% more than equivalent installations in China. Under a “trade war” projection with tariffs up to 30%, construction costs could rise by 15%.

This creates a highly volatile planning environment for developers and power buyers. A trusted VFD supplier or VFD manufacturer in China can help offset this instability by offering predictable pricing and high-quality solutions for industrial-scale solar inverters.

How Will the US Energy Storage Sector Be Affected?

While solar projects will be hit hard, energy storage faces an even more severe impact. This is primarily due to the US’s overwhelming reliance on battery cells from China. According to Wood Mackenzie, nearly all utility-scale storage projects in the US in 2024 used China-made cells. This creates a massive bottleneck under rising tariffs.

Under aggressive trade scenarios, energy storage costs could increase by 12% to 50%. With domestic battery cell production expected to meet only 6% of demand in 2025, and just 40% by 2030, the US is not positioned to fill this supply gap alone. Here, collaboration with an industrial inverter partner becomes strategic—by integrating optimized, tariff-resistant technologies and diversifying input sourcing, US developers can mitigate the tariff-driven cost spikes.

What Makes VFD Manufacturers in China a Strategic Advantage?

As global supply chains shift, VFD manufacturers in China like USFULL offer key advantages: scale, flexibility, and internationally certified products (CE, TUV, INMETRO). These suppliers already export to 90+ countries and support industrial clients across multiple continents.

Partnering with a VFD supplier in China ensures access to cost-effective, quality-assured variable frequency drives and solar pumping inverters—components that are essential in solar-powered motor control and energy optimization. Chinese manufacturers often support OEM branding, which enables US distributors to maintain competitiveness even under rising costs.

Additionally, these manufacturers are investing in R&D to develop products that align with global energy goals, making them more adaptable and forward-thinking industrial inverter partners.

How Can Developers Adapt Their Procurement Strategy?

The unpredictability of tariffs means buyers must rethink how and where they source. A diversified procurement strategy is key. Developers and project managers should:

Prioritize partnerships with industrial inverter partners that have global sourcing capabilities

Request multi-origin certification to avoid being caught under a single-country tariff

Source VFDs and inverters from suppliers with stock in multiple geographic zones

Establish contracts with built-in pricing buffers and flexible delivery terms

A VFD manufacturer in China with warehouses in Southeast Asia or Latin America, for example, can offer duty-reduced shipping while maintaining quality. Flexibility and transparency are now just as valuable as price.

What Are the Long-Term Risks of These Tariffs?

Beyond short-term cost inflation, tariffs create structural risks in the US energy transition:

Investment uncertainty: Developers are hesitant to commit to long-term PPAs when costs could spike unpredictably.

Missed climate targets: Delays in clean energy deployments could jeopardize national emissions goals.

Manufacturing slowdown: Gigafactory projects in the US have already been delayed or canceled due to unclear policy signals.

For companies dependent on timely imports, this means lost revenue and reputational damage. Working with experienced VFD suppliers who understand international compliance and logistics helps mitigate those risks and ensures more consistent fulfillment.

Which Markets Are Emerging as Alternative Opportunities?

While the US market faces policy headwinds, emerging regions—especially the Middle East, North Africa, and Southeast Asia—are showing accelerated demand for solar and storage infrastructure. Buyers in these markets are:

Price-sensitive, making them ideal for Chinese-made VFDs and solar components

Less regulated, allowing for faster deployment cycles

Rapidly scaling, increasing order volumes and long-term partnership potential

A VFD supplier with multilingual sales teams and global logistics can tailor strategies for these regions. For example, USFULL’s presence in over 90 countries makes it a flexible industrial inverter partner in volatile global conditions.

What Should Buyers Look for in an Industrial Inverter Partner?

Given today’s challenges, choosing the right industrial inverter partner is more critical than ever. Buyers should prioritize partners who:

Provide a full suite of industrial VFDs and solar pumping inverters

Hold multiple international certifications

Offer flexible OEM and branding options

Support global logistics and fast lead times

Have stable pricing despite geopolitical shifts

An ideal VFD manufacturer also invests in long-term R&D and supports energy efficiency goals aligned with local regulations.

Conclusion: Navigating Tariff Volatility Through Strategic Partnerships

As tariff pressures mount and the US solar and storage markets struggle with uncertainty, developers must turn to global partners who offer stability, scale, and flexibility. A reliable VFD manufacturer in China or industrial inverter partner is more than a supplier—they are a strategic ally in maintaining cost competitiveness, avoiding project delays, and navigating the complex terrain of global trade policy.

The road ahead may be uncertain, but with the right partners, the clean energy transition can stay on course.